Introduction

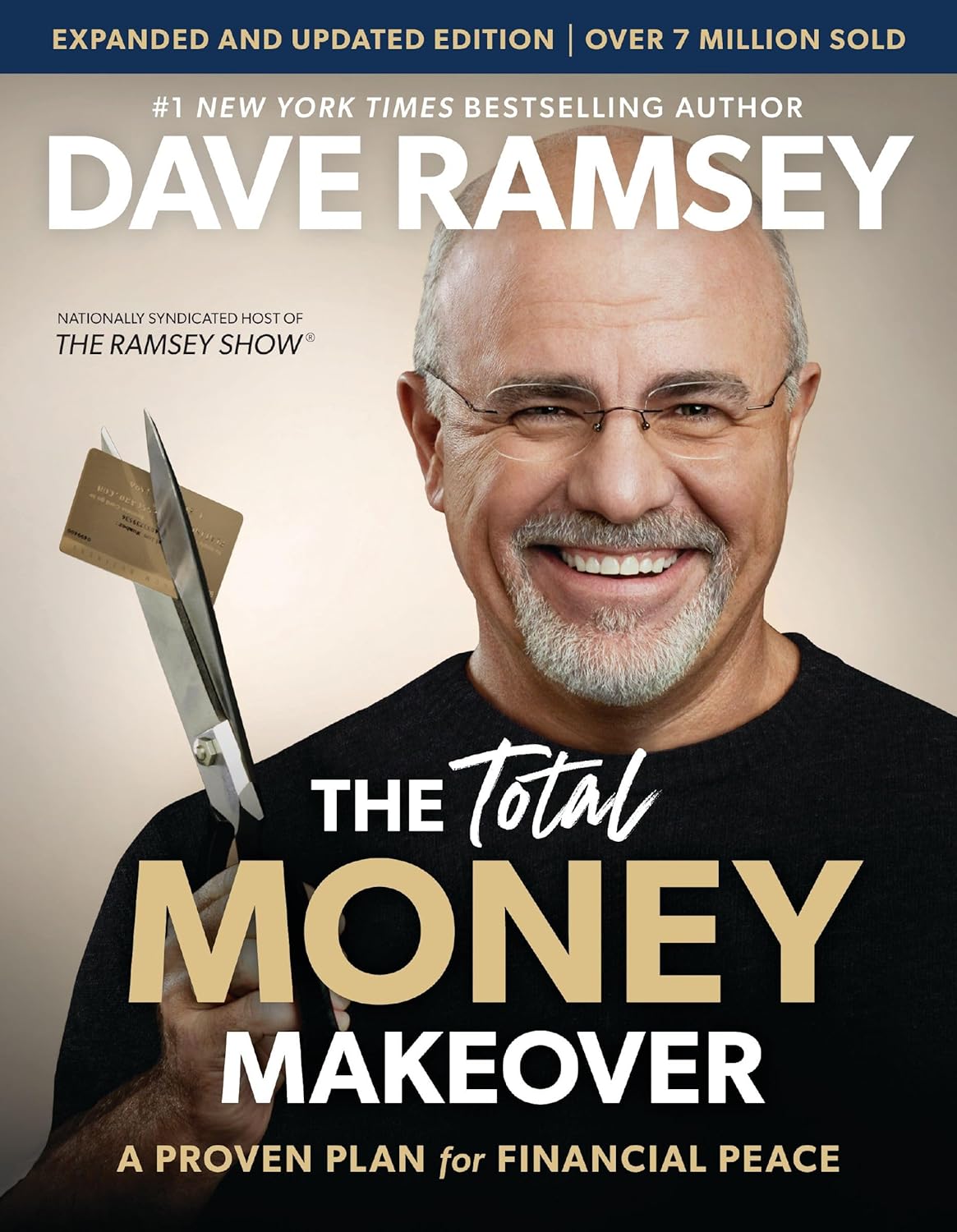

The Total Money Makeover is, probably, the most-read book in the realm of personal finance. Written by Dave Ramsey, an expert in financial education, this book provides a detailed roadmap to achieving financial independence. Ramsey’s method is simple and pragmatic, emphasizing debt control and long-lasting financial practices. Become debt free, it will change your life!

Dave Ramsey’s authority comes from his vast experience and success in helping people achieve financial security. His techniques are based on solid economic principles and supported by numerous entreladership reviews and endorsements from programs like Financial Peace University.

Reading The Total Money Makeover for the first time was eye-opening. The simplicity and effectiveness of Ramsey’s strategies immediately resonated with me. This book didn’t just teach me about money; it motivated me to adopt new habits for a financially secure future. My journey with this book sparked a deeper interest in reviewing it, hoping to share its transformative power with others seeking to regain control over their finances.

In my quest for knowledge, I stumbled upon Opinion Magnet, a platform that provides trustworthy product reviews. It’s an invaluable resource for anyone looking to delve deeper into personal finance products or services, offering comprehensive pros and cons that can aid in making informed decisions.

The Core Principles of ‘The Total Money Makeover‘

Dave Ramsey’s The Total Money Makeover is based on a few key principles designed to transform your financial life. At the heart of these principles are the Baby Steps, a series of deliberate actions that guide you toward financial freedom. Each step builds upon the previous one, making it a practical and effective roadmap.

Key Principles Highlighted in the Book:

- Living Debt-Free: The book strongly advocates for eliminating debt as a means to achieve financial security. By focusing on paying off debts quickly, you free up resources for future investments.

- Building an Emergency Fund: Establishing a safety net is crucial for managing unexpected expenses without falling back into debt.

- Investing Wisely: Long-term financial success is rooted in smart investments, particularly for retirement.

Ramsey emphasizes that adopting new money habits is essential for long-term financial stability. He introduces practical tips such as:

- Creating and sticking to a monthly budget.

- Avoiding lifestyle inflation by living below your means.

- Using cash instead of credit cards to control spending.

These principles are not just theoretical; they are actionable steps that anyone can implement. By changing your money habits, you pave the way for sustainable financial health and peace of mind.

1. The Seven Baby Steps Explained

Step 1: Building an Emergency Fund

Dave Ramsey’s first step in “The Total Money Makeover” emphasizes the importance of establishing an Emergency Fund. This foundational principle serves as a financial safety net, designed to cover unexpected expenses that life inevitably throws our way. Whether it’s an unexpected medical bill, car repair, or sudden job loss, having this cushion can mean the difference between a minor inconvenience and a major financial setback.

Why is an Emergency Fund crucial?

- Peace of Mind: Knowing you have a buffer can significantly reduce stress and anxiety related to financial uncertainties.

- Avoiding Debt: An emergency fund allows you to handle unexpected costs without resorting to credit cards or loans, thus preventing the accumulation of new debt.

- Financial Stability: It provides a stable foundation for your financial journey, ensuring that you can stay on track with other long-term goals.

Ramsey advocates for starting with a modest amount—$1,000—as an initial target. While it may seem small, this amount can cover many common emergencies. For those living paycheck to paycheck, reaching this milestone can be a significant achievement and a vital step towards financial security.

Personal Anecdote:

When I first read about the importance of an emergency fund, I was skeptical. However, after setting aside my initial $1,000, I quickly realized its value. A few months later, my car broke down unexpectedly. Instead of panicking and turning to my credit card, I dipped into my emergency fund and paid for the repairs outright. The relief I felt was profound; not only had I avoided additional debt, but I also experienced firsthand the peace of mind Ramsey describes.

Considerations for Building Your Fund:

- Start Small: Begin with manageable contributions. Even setting aside $10-$20 from each paycheck can accumulate quickly.

- Automate Savings: Use automatic transfers to move money into your emergency fund consistently.

- Keep It Accessible: Ensure your fund is in a readily accessible account—not too easily accessed to avoid temptation but available enough for urgent needs.

In essence, building an emergency fund is about creating a financial buffer that empowers you to face life’s surprises with confidence and resilience. This first step lays the groundwork for all subsequent phases in Dave Ramsey’s plan, making it indispensable in your journey toward financial freedom.

Step 2: The Debt Snowball Method in Action

The Debt Snowball Method is a powerful strategy for tackling debt, designed to provide psychological wins that keep you motivated. Here’s how it works:

- List Your Debts: Arrange all your debts from smallest to largest, regardless of interest rates.

- Pay Off the Smallest Debt First: Focus on paying off the smallest debt while making minimum payments on others.

- Repeat the Process: Once the smallest debt is cleared, move to the next smallest, applying the same intensity.

This method leverages the momentum created by small victories, like how a snowball gains size and speed as it rolls downhill.

Psychological Advantages

- Quick Wins: Paying off smaller debts quickly boosts morale and provides a sense of accomplishment.

- Increased Motivation: As each debt disappears, motivation grows to tackle larger ones.

- Simplified Focus: Concentrating on one debt at a time reduces overwhelm and increases financial clarity.

Real-life scenarios underscore the effectiveness of this approach. Take Jane, for instance. She had multiple debts—credit card balances, a car loan, and student loans. Using the Debt Snowball Method, she paid off her $500 credit card balance first. The triumph motivated her to tackle her $1,200 car loan next. Within two years, Jane was debt-free and ready to build her Fully Funded Emergency Fund, invest for retirement, and explore college savings options.

The Debt Snowball Method is more than just a repayment strategy; it’s a transformative approach that redefines your relationship with money and paves the way for long-term financial stability.

Step 3: Achieving Long-Term Security with a Fully Funded Emergency Fund

Saving enough to cover several months’ worth of expenses is crucial for long-term security. Dave Ramsey’s Fully Funded Emergency Fund is about having a safety net that protects you from life’s unexpected financial setbacks, such as medical emergencies, job loss, or major repairs.

Why is this important?

- Peace of Mind: Knowing you have a backup plan can greatly reduce stress and anxiety.

- Avoiding Debt: An emergency fund helps you avoid high-interest debt when unexpected expenses come up.

- Financial Stability: It ensures that your financial goals, such as Retirement Investing and College Savings, remain on track.

What does it involve?

A Fully Funded Emergency Fund usually covers 3 to 6 months’ worth of living expenses. This step comes after following the Debt Snowball Method, where you focus intensely on paying off debt. Once your debts are paid off, the next logical step is to build this strong emergency fund.

Consider this example: Imagine losing your job unexpectedly. Without this safety net, you’d be scrambling for money or taking on more debt. But with an emergency fund in place, you have the breathing room to find a new job without disrupting your financial plans.

In short, achieving long-term security through an emergency fund isn’t just about money—it’s about ensuring peace of mind and maintaining financial stability during tough times.

Step 4: Investing for Retirement Early On

Investing for retirement early on is a crucial step in The Total Money Makeover. The key here is time—starting early allows you to maximize the power of compound interest, which can significantly boost your retirement savings.

Why Start Early?

- Maximizing Compound Interest: The earlier you start investing, the longer your money has to grow. Compound interest works like magic, turning small, consistent contributions into substantial sums over time.

- Reducing Financial Stress Later: By investing early, you’re more likely to achieve financial stability and reduce stress as you approach retirement.

Investment Vehicles

Dave Ramsey emphasizes the importance of choosing the right investment vehicles for retirement:

- Roth IRAs: Contributions are made with after-tax dollars, but withdrawals during retirement are tax-free. This can be a huge advantage if you expect to be in a higher tax bracket when you retire.

- 401(k) Plans: Many employers offer matching contributions, which is essentially free money towards your retirement savings. Taking full advantage of this benefit can significantly accelerate your investment growth.

A personal anecdote might resonate here. When I first delved into the book, I realized how crucial it was to not just save but invest wisely. Setting up my Roth IRA felt empowering, knowing I was securing my financial future.

Investing for retirement early on is not just about securing your golden years—it’s about creating a legacy and ensuring long-term financial stability.

Step 5: College Savings Strategies That Work

Preparing financially for higher education expenses is a daunting task, but ‘The Total Money Makeover’ simplifies it with actionable strategies. Dave Ramsey emphasizes the need to adopt effective college savings methods to ensure a debt-free education for your children.

1. 529 Plans

529 Plans are one of the primary tools Ramsey recommends. These tax-advantaged savings plans are designed specifically for educational expenses. Contributions grow tax-free, and withdrawals for qualified education costs are also tax-exempt. This makes 529 Plans an excellent choice for long-term college savings.

2. Education Savings Accounts (ESAs)

Another powerful option is Education Savings Accounts (ESAs). ESAs function similarly to 529 Plans but come with different contribution limits and eligibility criteria. They offer flexibility in investment choices and can be used for K-12 expenses in addition to college costs.

Ramsey’s approach underscores the importance of starting early, harnessing the power of compound interest to maximize savings over time. By integrating these strategies into your financial planning, you can alleviate the burden of student loans and provide a solid financial foundation for your children’s future.

Incorporating these college savings strategies complements the earlier steps like building an Emergency Fund, utilizing the Debt Snowball Method, maintaining a Fully Funded Emergency Fund, and investing early for retirement. This holistic approach ensures you’re preparing comprehensively for every stage of financial life.

Step 6: The Benefits of Paying Off Your Mortgage Early

Paying off your mortgage early can be a game-changer for anyone aiming for financial freedom. Imagine the relief of not having that hefty monthly payment hanging over your head. Here’s why speeding up your mortgage payoff can lead to substantial benefits:

1. Interest Savings

By accelerating your payments, you significantly reduce the interest paid over the life of the loan. For instance, on a $200,000 mortgage at 4% interest, paying an extra $200 a month could save you thousands in interest.

2. Increased Financial Freedom

Without a mortgage, your cash flow opens up dramatically. This enables you to allocate funds toward other important areas like Retirement Investing, College Savings, or even building a Fully Funded Emergency Fund.

3. Psychological Peace

The sense of security that comes from owning your home outright cannot be overstated. It provides emotional stability and the confidence to pursue other financial goals without the looming debt burden.

4. Investment Opportunities

Freed-up money can be redirected into various investment vehicles, multiplying your wealth and ensuring long-term financial health.

Paying off your mortgage early is not just about financial gain but also about achieving peace of mind and expanding future opportunities. With each Baby Step from building an Emergency Fund to handling College Savings, this step ties them all together by freeing up resources and reducing financial stress.

Step 7: Building Wealth and Giving Back – A Holistic Approach to Financial Success

Accumulating wealth isn’t just about achieving personal financial stability; it’s about creating opportunities to make a substantial impact on your community. Dave Ramsey emphasizes that the journey doesn’t end once you’re debt-free and financially secure. The final step in The Total Money Makeover encourages you to think beyond yourself.

Wealth Building Strategies

Building wealth involves:

- Investing Wisely: Utilizing retirement accounts like Roth IRAs and 401(k)s.

- Diversifying Investments: Exploring stocks, bonds, real estate, and other assets.

- Consistent Saving: Maintaining a habit of saving a portion of your income.

These strategies are designed to provide long-term financial security and growth.

Giving Back

Ramsey advocates for using your accumulated wealth to give back through:

- Charitable Contributions: Donating to causes you care about.

- Philanthropy: Setting up foundations or endowments.

- Community Support: Investing in local businesses or community projects.

Role of Each Baby Step in Achieving Financial Stability:

- Emergency Fund: Creates a safety net for unexpected expenses.

- Debt Snowball Method: Helps eliminate debt systematically, reducing financial stress.

- Fully Funded Emergency Fund: Provides several months’ worth of expense coverage, offering peace of mind.

- Retirement Investing: Ensures long-term financial security.

- College Savings: Prepares for future educational expenses without incurring debt.

- Mortgage Payoff: Reduces overall interest payments, freeing up resources for other investments.

Each step builds upon the previous one, ensuring a comprehensive approach to financial health. By following these steps diligently, you not only secure your own future but also position yourself to contribute meaningfully to society.

Real-Life Testimonials: How ‘The Total Money Makeover‘ Changed Lives

Personal experiences with Dave Ramsey’s advice often provide the most compelling evidence of its effectiveness. Here are two impactful testimonials from individuals who have successfully implemented Ramsey’s principles, highlighting their transformation journeys.

1. Sarah and Michael’s Journey to Financial Freedom

“Before discovering The Total Money Makeover, our financial situation was a mess,” shares Sarah. “We were drowning in debt, barely making ends meet, and constantly stressed about money.”

Sarah and Michael decided to give Ramsey’s advice a try. They started with Baby Step 1, building a small emergency fund. This initial step gave them a sense of security. Then, they tackled Baby Step 2, using the Debt Snowball Method. Listing their debts from smallest to largest, they focused on paying off the smallest first.

“Seeing those small debts disappear one by one was incredibly motivating,” says Michael. “It made us believe we could actually become debt-free.”

After months of dedication and sacrifice, they paid off all their consumer debt. Moving to Baby Step 3, they saved enough to cover six months of expenses. Now, they’re working on investing for retirement and saving for their children’s college education.

2. John’s Path to Wealth-Building

John was a single professional struggling with student loans and credit card debt when he encountered The Total Money Makeover. Inspired by the book, he immediately started on Baby Step 1. After securing his $1,000 emergency fund, he moved on to tackle his debts using the Debt Snowball Method.

“The psychological boost from paying off my smallest debts first was game-changing,” John recalls. “I felt empowered and in control of my finances for the first time.”

Once debt-free, John didn’t stop there. He continued through the subsequent Baby Steps, eventually paying off his mortgage early—a milestone that significantly reduced his monthly expenses and allowed him to allocate more towards investments.

“Becoming mortgage-free opened up so many possibilities,” says John. “Now I can focus on building wealth and giving back to my community.”

These stories illustrate the transformative power of adopting Ramsey’s principles. Through hard work and commitment, both Sarah and Michael, as well as John, achieved financial freedom, proving that The Total Money Makeover is more than just a book—it’s a life-changing guide to financial success.

Exploring Additional Resources by Dave Ramsey

Dave Ramsey’s financial wisdom extends beyond the pages of The Total Money Makeover. His suite of tools and resources can further aid anyone on their journey to financial freedom. Let’s delve into some of these invaluable assets:

EveryDollar: The Budgeting App

EveryDollar is a budgeting app designed to simplify money management. This tool aligns perfectly with Ramsey’s principles, making it an excellent companion to The Total Money Makeover.

My Review: Having used EveryDollar myself, I found it remarkably effective in maintaining budget discipline. The ability to customize categories and track spending has been a game-changer.

Key Features

- User-Friendly Interface: The app is intuitive, allowing users to create a monthly budget in minutes.

- Zero-Based Budgeting: EveryDollar incorporates zero-based budgeting, ensuring every dollar has a purpose—one of Ramsey’s core teachings.

- Track Spending: Users can track expenses effortlessly, staying aligned with their financial goals.

SmartVestor Program

For those looking to invest wisely, the SmartVestor program connects individuals with trusted investment professionals.

My Experience: Engaging with a SmartVestor Pro provided me clarity on retirement planning. Their expertise helped demystify complex investment options, aligning them with my long-term goals.

Benefits of SmartVestor Program

- Trusted Advisors: SmartVestor Pros are vetted and endorsed by Ramsey, ensuring they align with his financial philosophies.

- Educational Resources: The program offers insights into various investment strategies, tailored to individual needs.

Financial Coaching

Ramsey’s network also includes personalized financial coaching, offering one-on-one guidance for those needing tailored advice.

Coaching Insight: A friend’s experience with a financial coach highlighted how personalized guidance can accelerate progress towards financial goals. Their coach’s accountability was crucial in maintaining momentum.

Advantages of Financial Coaching

- Certified Coaches: These professionals undergo rigorous training to provide advice consistent with Ramsey’s principles.

- Personalized Plans: Coaches help develop customized plans that address unique financial situations.

Financial Peace University (FPU)

The Financial Peace University is an educational course that deepens understanding of personal finance through structured lessons.

Course Review: Testimonials from FPU graduates often mention the profound impact of the course on their financial lives. The structured approach and peer support play significant roles in their success stories.

Curriculum Overview

FPU covers various aspects of personal finance:

- Budgeting

- Debt elimination

- Investing

- And more

Insurance Reviews

Ramsey also provides comprehensive reviews on various types of insurance through his platform.

Types of Insurance Reviewed

- Life Insurance: Emphasizes term life insurance over whole life policies.

- Health Insurance: Guides on choosing the best health coverage without overpaying.

Practical Advice: His detailed reviews help simplify the often-confusing insurance landscape, empowering readers to make informed choices.

These additional resources complement The Total Money Makeover, providing practical tools and expert guidance. They enhance the journey towards financial freedom, offering support at every step.

Why Being Debt-Free is Important for Your Well-Being

Becoming debt-free is more than just a financial milestone; it’s a gateway to a richer, more fulfilling life. When you eliminate debt, you unlock numerous benefits that extend far beyond the realm of money management.

Financial Stability and Peace of Mind

One of the most immediate advantages of being debt-free is experiencing what Dave Ramsey calls financial peace. Without the burden of debt:

- You gain control over your income: Instead of funneling money towards interest payments, you can allocate resources to savings, investments, or personal enjoyment.

- Your risk tolerance increases: With no debt obligations hanging over your head, you’re better positioned to take calculated financial risks that could yield higher returns.

- Emergency readiness improves: A debt-free lifestyle often includes a robust emergency fund, providing a cushion during unexpected events like job loss or medical emergencies.

Mental Health Benefits

Debt is not just a financial strain; it can be a significant source of stress and anxiety. Freeing yourself from debt can lead to:

- Reduced stress levels: Knowing that you owe nothing relieves the constant pressure and worry about meeting monthly payments.

- Improved sleep quality: Financial worries often lead to sleepless nights. Eliminating debt helps in achieving better rest and overall health.

- Enhanced mental clarity: Without the distraction of financial woes, you can focus on other aspects of life, such as career goals or personal relationships.

“The weight lifted off my shoulders was immense,” says one reader who followed Ramsey’s plan. “I feel like I can breathe again.”

Quality of Life Enhancements

The benefits of living without debt ripple out to virtually every aspect of life. Some notable improvements include:

- Freedom to pursue passions: With no debt tying you down, you have the liberty to explore hobbies or even start a business.

- Stronger relationships: Financial stress often strains relationships. Being debt-free fosters better communication and fewer arguments about money.

- Ability to give back: Financial freedom enables more generous charitable contributions, amplifying your positive impact on society.

In essence, achieving a debt-free status provides both tangible and intangible rewards. It not only stabilizes your finances but also enhances your overall well-being and quality of life. Each step towards eliminating debt is a step towards reclaiming control and finding true financial peace.

Conclusion: Taking Control of Your Finances with ‘The Total Money Makeover’

Taking control of your finances is more than just managing money; it’s about changing your life. ‘The Total Money Makeover’ by Dave Ramsey isn’t just a book; it’s a guide to achieving financial freedom. If you want to escape debt and secure your future, this book is a must-read.

Why should you buy ‘The Total Money Makeover’?

- Proven Principles: Ramsey’s strategies have been tried and tested by millions. The seven baby steps provide a clear, actionable path that anyone can follow.

- Holistic Approach: It’s not just about paying off debt; it’s about changing your relationship with money and adopting habits that lead to long-term success.

- Real-Life Relevance: The principles are practical and can be applied regardless of where you are on your financial journey.

“Financial peace isn’t the acquisition of stuff. It’s learning to live on less than you make, so you can give money back and have money to invest.” – Dave Ramsey

Imagine the peace of mind that comes with being debt-free, the joy of seeing your savings grow, and the fulfillment of giving back to your community. This transformative power lies at the heart of ‘The Total Money Makeover’.

By taking control over your personal finances, you’re not just changing your bank balance—you’re changing your life. So why wait? Buy ‘The Total Money Makeover’ today and start your journey toward financial independence and lasting peace.

Embrace the challenge, trust the process, and watch as each step brings you closer to a future filled with possibilities.

FAQs (Frequently Asked Questions)

What is ‘The Total Money Makeover’ and why is it significant?

‘The Total Money Makeover’ is a personal finance book by Dave Ramsey that emphasizes practical steps for achieving financial freedom. It is significant in the personal finance world for its straightforward approach to debt management and wealth building, helping countless individuals transform their financial lives.

Who is Dave Ramsey and what makes him credible in financial literacy?

Dave Ramsey is a well-known financial expert, author, and radio host with over 25 years of experience in personal finance. His credibility stems from his own journey of overcoming financial struggles, along with his proven track record of helping others achieve financial peace through his books, courses, and programs.

What are the core principles of ‘The Total Money Makeover’?

The core principles of ‘The Total Money Makeover’ revolve around adopting new money habits that lead to long-term financial success. This includes following the Seven Baby Steps designed to help individuals build an emergency fund, pay off debt, save for retirement, and ultimately achieve financial independence.

Can you explain the Debt Snowball Method mentioned in the book?

The Debt Snowball Method is a debt repayment strategy where individuals focus on paying off their smallest debts first while making minimum payments on larger debts. This approach builds psychological momentum as each small debt is eliminated, leading to increased motivation to tackle larger debts.

How does being debt-free contribute to overall well-being?

Being debt-free significantly contributes to overall well-being by reducing stress and anxiety associated with financial burdens. It fosters mental clarity and improves quality of life, allowing individuals to focus on their goals and enjoy life without the constant worry of debt repayments.

What additional resources does Dave Ramsey offer alongside ‘The Total Money Makeover’?

In addition to ‘The Total Money Makeover’, Dave Ramsey offers several complementary tools such as the EveryDollar budgeting app for effective money management and the SmartVestor program for investment guidance. These resources enhance the principles outlined in the book, providing practical support on the journey to financial freedom.

Leave a comment