Introduction

Achieving a debt-free life is more than just a financial goal—it’s a transformative journey toward long-lasting financial freedom. The importance of being debt-free cannot be overstated. It alleviates stress, opens up opportunities, and provides a sense of security for both individuals and families.

Benefits of Living Debt-Free:

- Financial Security: No more juggling between bills and contemplating which debt to prioritize.

- Increased Savings: Redirect funds from debt payments to savings and investments.

- Improved Relationships: Reduce financial strain that can often affect personal relationships.

- Greater Freedom: More choices about career paths, living situations, and lifestyle decisions.

Embarking on the path to becoming debt-free involves several well-defined steps. These include creating a debt payoff plan, mastering budgeting basics, automating payments, employing effective debt payoff strategies, increasing income, cutting unnecessary expenses, considering debt consolidation options, and adopting a mindset change with accountability.

Ready to transform your financial future? Let’s dive into these steps in detail and set you on the path to achieving your dream of financial freedom.

To aid in this journey, it’s crucial to make informed decisions. For instance, when considering new financial products or services as part of your strategy, discover product reviews that you can trust. Why guess? Get all the knowledge you need – Pros and Cons.

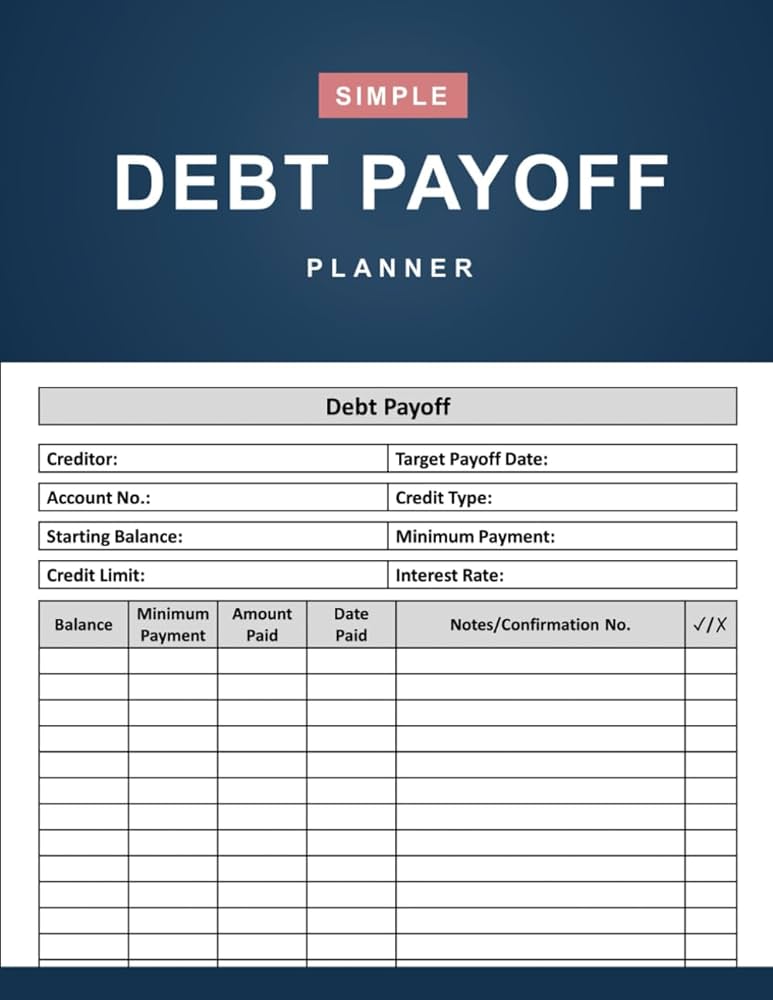

Step 1: Create a Debt Payoff Plan

Get this on Amazon

Taking the first step towards a debt-free life involves creating a debt payoff plan. Establishing a clear timeline for debt repayment is crucial. Without a roadmap, it becomes easy to lose track of progress and feel overwhelmed by the magnitude of the task.

Establishing a Clear Timeline

- Set Specific Goals: Break down your debt into manageable chunks with specific deadlines. For example, aim to pay off $1,000 in credit card debt within three months.

- Use Milestones: Celebrate small victories along the way to stay motivated. Consider marking each milestone on your calendar.

Tracking All Expenses Effectively

Understanding where your money goes is fundamental in managing and eliminating debt. Here’s how you can track expenses effectively:

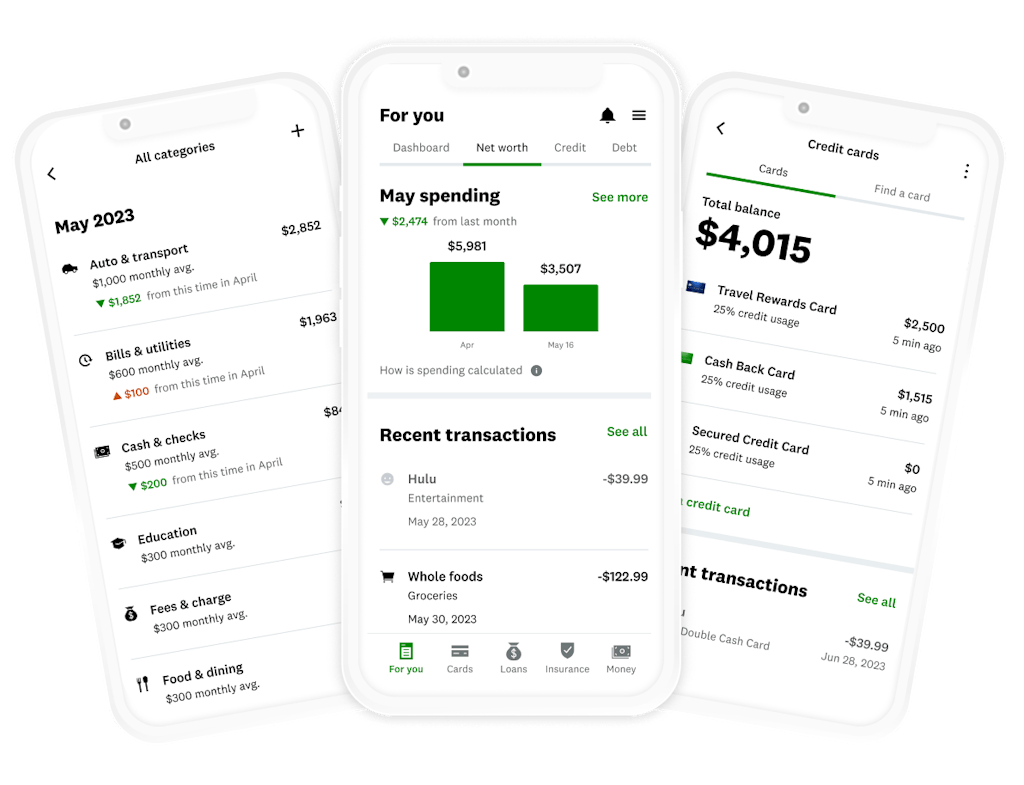

- Use Apps: Tools like Mint or YNAB (You Need A Budget) can automatically categorize and track transactions, providing a clear picture of your spending habits.

- Manual Tracking: Maintain a spreadsheet or a ledger to record every expense. This old-school method gives you hands-on control over your finances.

- Review Regularly: Set aside time each week to review your expenses and adjust where necessary. This habit helps in identifying patterns and areas where you can cut back.

Setting Priorities for Paying Off Debts

Not all debts are created equal. It’s essential to prioritize which debts to tackle first:

- High-Interest Debts: Focus on paying off high-interest debts like credit cards before others. The interest can accumulate quickly, making it harder to pay down the principal.

- Small Balances: Paying off smaller balances first can provide psychological boosts and build momentum.

Creating a detailed debt payoff plan sets the foundation for achieving financial freedom. By establishing a timeline, tracking expenses meticulously, and setting clear priorities, you create a structured approach that makes the journey manageable and less daunting.

Step 2: Budgeting Basics

The 50/30/20 Budgeting Rule

Understanding the 50/30/20 rule serves as a foundational step in managing your finances effectively. This budgeting strategy divides your after-tax income into three categories:

- 50% Needs: Essential expenses such as housing, utilities, groceries, and transportation.

- 30% Wants: Lifestyle choices including dining out, entertainment, and vacations.

- 20% Savings/Debt Repayment: Allocating funds towards savings accounts, emergency funds, or paying off debt.

Adopting this rule can clarify where your money is going and ensure that you’re not overspending on non-essentials.

Tips for Maintaining a Realistic Budget

Creating a budget is one thing; sticking to it is another. Here are some practical tips for maintaining a realistic budget:

- Track Your Spending: Use apps like Mint or YNAB (You Need A Budget) to monitor expenses.

- Adjust Regularly: Your financial situation may change; adapt your budget accordingly.

- Prioritize Needs Over Wants: Ensure essential expenses are covered before spending on luxuries.

Budgeting is not about deprivation but about making informed choices that align with your financial goals.

Importance of Financial Organization

Being organized is crucial in managing spending and adhering to your budget. Some effective strategies include:

- Organize Bills and Statements: Keep all financial documents in one place, either digitally or physically.

- Use Financial Tools: Tools like spreadsheets or budgeting apps can help track income and expenses efficiently.

- Schedule Regular Reviews: Set aside time each month to review your budget and make necessary adjustments.

By staying organized, you gain better control over your finances and can more easily identify areas for improvement.

Mastering budgeting basics lays the groundwork for financial stability and ensures you remain on track toward achieving a debt-free life.

Step 3: Automate Payments

Ensuring your debt payments are always on time can be a game-changer. Automate payments to reap multiple benefits that ease the path to becoming debt-free.

Benefits of Setting Up Automatic Payments for Debts

- Consistency: Automation ensures that you never miss a payment, maintaining a steady progress toward debt reduction.

- Stress Reduction: By setting up automatic transfers, the process becomes effortless, freeing your mind from constant reminders.

- Credit Score Improvement: Regular, on-time payments positively impact your credit score, opening doors for better financial opportunities.

How Automation Helps in Avoiding Late Fees and Penalties

Late fees and penalties can accumulate quickly, adding unnecessary strain to your finances. When you automate payments:

- Avoid Late Fees: Payments are made on time every month, eliminating the risk of incurring late fees.

- Prevent Penalties: Consistent payments mean avoiding penalties that come with delayed or missed payments.

- Better Financial Management: Automation ensures funds are allocated correctly, helping you manage finances more efficiently.

Tools and Apps Available for Automating Payments

Several tools and apps make automating payments straightforward:

- Bank Services: Most banks offer automatic bill payment services. Set it up through your online banking portal.

- Budgeting Apps: Apps like Mint and YNAB (You Need A Budget) not only help track expenses but also allow you to schedule automatic payments.

- Debt Management Tools: Platforms such as Undebt.it and Tally specifically focus on helping you manage and automate debt repayments.

Embrace these technologies to streamline your financial management and stay ahead in your journey towards being debt-free.

Step 4: Effective Debt Payoff Strategies

When it comes to strategies to pay off debt, two popular methods often come into play: the debt snowball method and the debt avalanche method. Each has unique advantages and can be tailored to fit individual financial situations.

Debt Snowball Method

The debt snowball method involves paying off your smallest debts first, regardless of interest rates. Once a smaller debt is paid off, the money that was used for those payments is then applied to the next smallest debt, creating a “snowball” effect.

Advantages

- Provides quick wins and boosts motivation.

- Simplifies the process by focusing on one debt at a time.

Disadvantages

- May result in paying more interest over time compared to other methods since higher-interest debts are not prioritized.

Debt Avalanche Method

The debt avalanche method focuses on paying off debts with the highest interest rates first. Once the highest-interest debt is paid off, you move to the next highest interest rate, which can save money on interest payments in the long run.

Advantages

- Minimizes total interest paid over time.

- Can lead to faster overall debt elimination if high-interest debts are significant.

Disadvantages

- Progress may feel slower initially since high-interest debts might also be larger balances.

- Requires more discipline as early victories are less frequent.

Real-Life Examples and Success Stories

Jenny’s Journey: Jenny had five different credit card debts ranging from $500 to $5,000. Using the debt snowball method, she targeted her smallest $500 balance first. Each paid-off card gave her a sense of accomplishment, keeping her motivated. Over two years, she successfully cleared all her debts.

Mark’s Mission: Mark had several student loans and credit card balances with varying interest rates. He opted for the debt avalanche method, targeting his 18% APR credit card first. Although progress was slow at first, he saved thousands in interest over three years and eventually became debt-free.

Both methods have their merits, making them valuable tools in your journey towards a debt-free life. Choose the one that aligns best with your personal financial situation and psychological preferences for effective results.

Step 5: Increase Your Income

Increasing your income is a powerful way to accelerate debt repayment. By exploring additional income sources, you can make significant strides toward a debt-free life.

Ideas for Side Hustles or Freelance Work to Boost Income

Engaging in side hustles or freelance work can provide that needed financial boost:

- Freelancing: Platforms like Upwork and Fiverr offer opportunities in writing, graphic design, and programming.

- Ride-sharing or Delivery Services: Companies such as Uber, Lyft, or DoorDash allow you to earn money by driving or delivering goods.

- Tutoring or Teaching: Offer your expertise in subjects you excel at through online tutoring platforms like VIPKid or Chegg Tutors.

- Handyman Services: Websites like TaskRabbit connect you with people needing help with household tasks.

Selling Unused Items as a Quick Cash Solution

Clearing out clutter not only simplifies your life but also generates extra cash:

- Online Marketplaces: Sell items on eBay, Craigslist, or Facebook Marketplace.

- Consignment Shops: These stores can sell your clothing and accessories for a commission.

- Garage Sales: Hosting a garage sale is a traditional yet effective method for quick sales.

Importance of Increasing Income to Accelerate the Journey Towards Being Debt-Free

Every dollar earned above your regular income can be directed towards debt repayment:

- Debt Reduction: Extra income reduces the principal amount faster, saving interest costs.

- Financial Cushion: Additional earnings create a buffer for unexpected expenses, preventing new debt accumulation.

- Motivation Boost: Seeing tangible progress in your debt reduction journey is motivating and encourages persistency.

Increasing your income through side hustles, freelance work, or selling unused items can significantly impact your journey towards financial freedom. This proactive approach not only brings you closer to being debt-free but also instills a sense of empowerment and control over your financial destiny.

Step 6: Cut Unnecessary Expenses

Eliminating non-essential spending is a crucial step in achieving debt freedom. Identifying areas where you can cut back can have a significant impact on your financial health.

Identify Areas to Cut Back

Start by examining your recurring expenses. Subscriptions are often overlooked but can add up quickly:

- Streaming Services: Do you really need multiple streaming subscriptions?

- Gym Memberships: Are you using it regularly, or could home workouts be just as effective?

- Magazine and App Subscriptions: Evaluate if they bring enough value to justify their cost.

Tips on Frugal Living

Adopting frugal living habits doesn’t mean sacrificing quality of life. Here are some saving money tips that make a difference:

- Smart Shopping: Use coupons, wait for sales, and buy in bulk.

- Meal Planning: Plan weekly meals to avoid last-minute takeout.

- Energy Efficiency: Small changes like LED bulbs and unplugging devices can reduce utility bills.

Impact on Financial Health

Reducing unnecessary expenses directly improves your financial stability:

“A penny saved is a penny earned.” – Benjamin Franklin

By cutting back on non-essential spending, you free up more resources to allocate toward debt repayment. This not only speeds up your journey to being debt-free but also instills disciplined financial habits that benefit you long-term.

Balancing needs and wants is crucial. Prioritize what’s truly important and watch your savings grow as your debts diminish.

Step 7: Consider Debt Consolidation Options

Debt consolidation can be a powerful tool in your journey towards financial freedom. By combining multiple debts into one, you streamline your payments and often secure a lower interest rate.

How Debt Consolidation Works and Its Benefits

Debt consolidation involves taking out a new loan to pay off multiple existing debts. This process simplifies your monthly payments into one manageable amount, ideally with a lower interest rate.

Benefits of Debt Consolidation:

- Lower Interest Rates: Often, the new loan has a lower interest rate than your current debts.

- Simplified Payments: One payment means less chance of missing due dates.

- Improved Credit Score: Consistent payments can boost your credit over time.

Different Options Available

Several methods exist for consolidating debt:

- Personal Loans: A personal loan from a bank or credit union can be used to pay off high-interest debts.

- Balance Transfer Credit Cards: These cards offer low or zero percent interest rates on transferred balances for an introductory period. Perfect for tackling high-interest credit card debt.

- Home Equity Loans or HELOCs: For homeowners, borrowing against home equity can provide funds at lower interest rates.

- Debt Management Plans: Offered by credit counseling agencies, these involve negotiating with creditors to reduce interest rates and consolidate payments.

When to Consider Seeking Professional Help

Professional help may be necessary if:

- You Feel Overwhelmed: Handling multiple debts alone is stressful and confusing.

- You Need Expert Advice: Financial advisors can offer tailored solutions.

- Negotiations Are Needed: Professionals can negotiate better terms with creditors on your behalf.

Debt consolidation options, like balance transfer credit cards and personal loans, can significantly ease the burden of repayment. Engaging professional help ensures you’re making informed decisions tailored to your unique financial situation.

Step 8: Mindset Change and Accountability

Importance of Changing Your Perspective on Credit Use and Consumerism

A money mindset change is essential in the journey to becoming debt-free. Shifting your perspective on credit use and consumerism involves:

- Recognizing Needs vs. Wants: Understand the difference between necessary purchases and impulse buys.

- Adopting a Minimalist Approach: Embrace the idea that less can be more, focusing on quality over quantity.

- Valuing Experiences Over Material Goods: Appreciate moments and experiences rather than accumulating possessions.

How an Accountability Partner Can Help

Staying committed to your financial goals can be challenging, but having an accountability partner makes a significant difference. Here’s how:

- Regular Check-ins: Scheduling routine meetings to review progress keeps you focused.

- Mutual Encouragement: Sharing successes and setbacks with someone who understands your goals fosters perseverance.

- Objective Feedback: An accountability partner provides honest opinions, helping you stay on track.

Strategies for Maintaining Motivation Throughout the Journey

Maintaining motivation is crucial for long-term success. Consider these strategies:

- Set Milestones and Celebrate Small Wins: Recognize every achievement, no matter how minor, to keep morale high.

- Visualize Your Debt-Free Future: Create vision boards or write down what life will look like once debt-free.

- Educate Yourself Continuously: Read books, listen to podcasts, or attend workshops about financial freedom.

Shifting your mindset and finding an accountability partner are game-changers in achieving a debt-free life. These steps not only help in managing finances better but also ensure that you stay motivated throughout your journey.

Products to Assist Your Journey Toward Being Debt-Free

Embarking on the journey toward financial freedom often requires some practical tools. Utilizing a few key products can make a significant difference in managing your finances efficiently and effectively. Here are some highly recommended Amazon products for debt freedom:

1. Budget Planners

Budget planners are essential tools for keeping track of your income, expenses, and progress toward debt freedom. Examples include:

- Clever Fox Budget Planner: With monthly budget sections, expense trackers, and bill organizers, this planner helps you stay organized.

- Erin Condren Monthly Planner: Known for its quality and detailed layouts, it’s perfect for meticulous financial planning.

2. Financial Management Books

Reading up on financial strategies can provide valuable insights and motivation. Consider these popular books:

- “The Total Money Makeover” by Dave Ramsey: A step-by-step guide to achieving financial fitness.

- “You Are a Badass at Making Money” by Jen Sincero: Offers an engaging approach to changing your money mindset.

3. Apps and Systems

Automating your finances can save time and ensure you never miss a payment. Useful apps include:

- YNAB (You Need A Budget): Helps you allocate every dollar efficiently.

- Mint: Provides comprehensive financial tracking and budgeting features.

4. Envelopes for Cash Management

The cash envelope system can be effective for controlling spending on variable expenses:

- Rnairni Cash Envelope System: Includes categorized envelopes to help manage different spending areas.

- Lamare Cash Envelope Wallet: Stylish and functional, making budgeting easy while on the go.

5. Debt Reduction Calculators

Calculators specifically designed to help you strategize debt repayment:

- Debt Payoff Calculator by Crown Financial Ministries: Offers clear visualizations of your progress.

- Financial Peace University’s Debt Snowball Calculator: Aligns with the debt snowball method, aiding in prioritizing debts.

6. Educational Course

Gaining more knowledge through structured learning can be beneficial:

- Financial Peace University: Dave Ramsey’s course is renowned for teaching practical steps toward financial stability.

7. Financial Journal

Journals dedicated to tracking financial goals and reflections can keep you motivated:

Using these products not only aids in managing your current finances but also fosters positive habits that contribute to long-term debt freedom. Each tool offers unique benefits tailored to different aspects of personal finance management, ensuring there’s something suitable for everyone on their journey to becoming debt-free.

Motivational Role of Success Stories

1. Inspiration and Hope

Hearing about others’ successes instills a sense of possibility. It reassures those struggling that achieving a debt-free life is attainable.

2. Practical Tips

Success stories often come with detailed strategies that can be emulated. From budgeting techniques to income-boosting ideas, these narratives provide practical roadmaps.

3. Accountability and Community Support

Sharing progress within a community fosters accountability. Witnessing peers’ achievements can motivate individuals to stay committed to their own financial goals.

Financial success stories serve as powerful reminders that with dedication and the right strategies, anyone can overcome financial struggles and achieve freedom from debt.

Conclusion

Embracing the journey towards a debt-free life isn’t just about reducing financial stress—it’s about securing your future. Think of it as laying a solid foundation for your financial stability, one step at a time.

Take Action Now

- Start Today: Use the steps outlined in this guide to create your own path to debt freedom.

- Stay Committed: Remember, every small effort counts and brings you closer to your goal.

- Keep Learning: Continuously educate yourself on personal finance to make informed decisions.

Your Debt-Free Journey Awaits

It’s time to take charge of your financial well-being. Begin your debt-free journey today and experience the freedom and security that comes with it. Share your progress, find an accountability partner, and celebrate each milestone along the way.

Ready to start? The first step is just a decision away.

FAQs (Frequently Asked Questions)

What are the benefits of living a debt-free life?

Living a debt-free life offers numerous benefits, including increased financial stability, reduced stress, and the ability to save and invest more effectively. Individuals and families can enjoy greater freedom in their financial choices, enabling them to plan for future goals without the burden of debt.

How can I create an effective debt payoff plan?

To create a successful debt payoff plan, start by establishing a clear timeline for repayment. Track all your expenses meticulously and set priorities for which debts to pay off first. This structured approach will help you stay focused and motivated on your journey to becoming debt-free.

What is the 50/30/20 budgeting rule?

The 50/30/20 budgeting rule is a simple guideline for managing your finances effectively. It suggests allocating 50% of your income to needs (essential expenses), 30% to wants (discretionary spending), and 20% to savings or debt repayment. This method helps maintain a balanced budget while ensuring you prioritize important financial goals.

What are some effective strategies for paying off debt?

Two popular strategies for paying off debt are the debt snowball method and the debt avalanche method. The snowball method focuses on paying off smaller debts first for quick wins, while the avalanche method prioritizes debts with the highest interest rates. Each strategy has its advantages and disadvantages, so it’s important to choose one that aligns with your financial situation and motivation.

How can I increase my income to pay off debt faster?

To accelerate your journey towards being debt-free, consider exploring side hustles or freelance work that can provide additional income. Selling unused items around your home can also yield quick cash. Increasing your income allows you to allocate more funds towards paying off debts, shortening the time it takes to achieve financial freedom.

When should I consider debt consolidation?

Debt consolidation may be a viable option when you have multiple debts with high interest rates that you want to combine into a single payment with lower rates. It simplifies repayment and can potentially reduce monthly payments. However, it’s important to evaluate all options carefully and seek professional advice if needed before proceeding with consolidation.

Leave a comment